Share This Article

In the heart of Southeast Asia, a battle is brewing. ASEAN countries like Malaysia, Vietnam, and Singapore are rapidly scaling up their semiconductor sectors, hoping to become key players in the global chip supply chain. However, Thailand—known for its manufacturing prowess in industries like automotive and electronics—has been comparatively slow to join the race. As global supply chain vulnerabilities push tech giants to diversify production bases, Thailand must urgently address its strategic gap if it wants a seat at the semiconductor table.

The Rising Tide of ASEAN’s Semiconductor Market

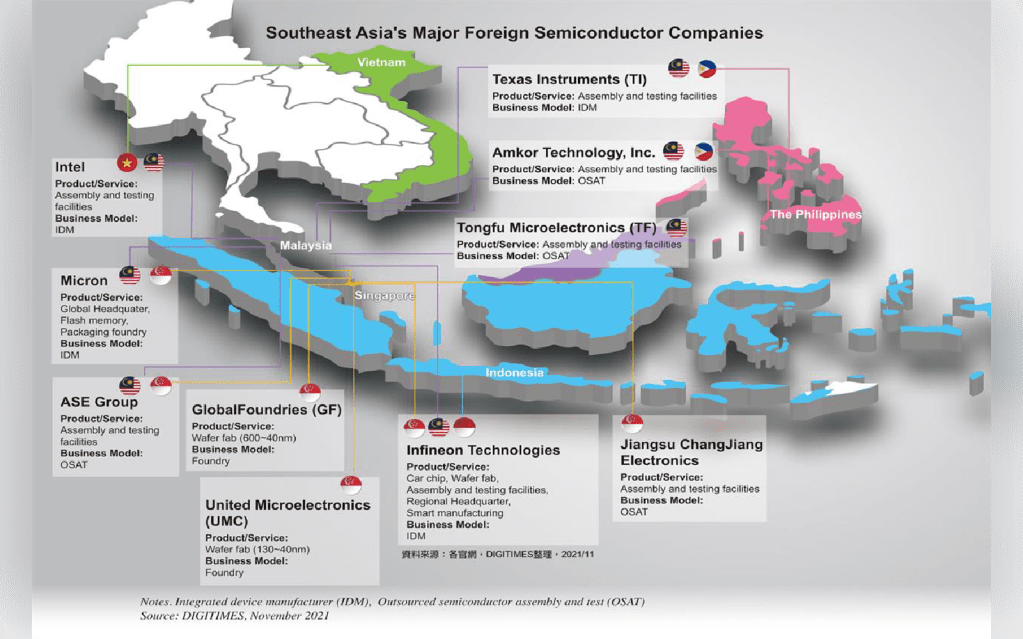

Southeast Asia’s semiconductor industry is booming. Malaysia has attracted global companies with its strong electronics manufacturing industry. Meanwhile, Singapore is becoming a regional hub for semiconductors, supported by significant government help.

Vietnam is also attracting a lot of foreign direct investment (FDI) in high-tech manufacturing. Samsung’s $22.4 billion commitment shows that the country is becoming a more appealing place for production. Additionally, Samsung is committed to training 50,000 semiconductor engineers by 2030 through collaborations with Vietnamese educational institutions. This reflects its long-term strategy to bolster the local workforce and enhance Vietnam’s semiconductor capabilities.

These ASEAN countries are not only competing with each other but are also positioning themselves as cost-effective alternatives to China, especially as the U.S.-China chip war intensifies. However, Thailand’s urgency to enter the semiconductor industry is relatively new. Thailand has done well in industries like automotive and consumer electronics, but it struggles in the semiconductor manufacturing sector. The complexity and capital intensity of semiconductor manufacturing have caused it to fall behind its regional neighbours in this critical sector.

Thailand’s Current Semiconductor Industry: Stuck in Low Gear

Unlike Singapore or Malaysia, Thailand lacks a strong foothold in the core areas of semiconductor manufacturing, such as wafer fabrication and chip assembly and testing. Historically, the semiconductor sector in Thailand has focused on “back-end” activities. This includes chip assembly and packaging, which are vital but less lucrative than front-end manufacturing processes like fabrication. This limited role in the semiconductor value chain has hindered Thailand’s ability to attract large-scale investments from chip giants like Taiwan’s TSMC or America’s Intel.

According to an analysis by The Business Times, despite a push for tech diversification, Thailand’s semiconductor market growth has been sluggish. Part of the issue stems from Thailand’s late start and limited infrastructure for semiconductor manufacturing. Without a clear, aggressive policy or an existing semiconductor cluster, Thailand will not be able to capitalise on the surge in global semiconductor demand and earn a market share.

Reasons Why Thailand Is Falling Behind in the Chip Industry

1. Insufficient Infrastructure and Expertise

Establishing semiconductor manufacturing facilities requires immense capital investment, sophisticated infrastructure, and a highly skilled workforce—areas where Thailand has historically lagged. Unlike the established semiconductor hubs of Taiwan, South Korea, or Singapore, Thailand lacks the infrastructure backbone required for cutting-edge chip manufacturing, which involves high levels of automation and advanced water and energy management systems.

2. A Late Start in Policy and Investment

Government support is essential for the growth of the semiconductor industry. For example, Singapore has successfully attracted significant investments by dedicating billions of dollars to research and development (R&D) and offering incentives to high-tech manufacturing firms.

Thailand, however, has only recently started focusing on semiconductor development. According to Nation Thailand, its policies are still in the early stages of implementation, which has resulted in the country lagging behind. In an industry where speed and early positioning are vital for success, this delay puts Thailand at a disadvantage.

3. Intense Regional Competition

While Thailand has been slow to react, neighbouring countries have been proactive. Malaysia’s semiconductor sector benefits from close ties with global giants like Infineon and Texas Instruments, while Vietnam’s low-cost labour and favourable tax incentives have enticed firms like Samsung to expand their chip production there. These competitive advantages leave Thailand with limited leverage to attract major semiconductor players.

Opportunities Amidst Challenges: Thailand’s Path to a Competitive Position

Despite the obstacles, Thailand possesses certain strengths that could help it carve out a competitive position in the semiconductor sector. Its experience in electronics and automotive manufacturing means that the country has a robust industrial base and a skilled workforce that could be retrained for semiconductor roles.

Its strategic location is another important criterion that has attracted foreign investments in other industries, and semiconductors are no different. Moreover, the Thai government has recently launched initiatives to boost semiconductor-related FDI, such as the Eastern Economic Corridor (EEC), which aims to establish Thailand as a hub for advanced manufacturing and logistics.

1. Developing Stronger Government Initiatives

For Thailand to compete, it must follow the examples of regional peers by offering more incentives for semiconductor companies. Expanded tax breaks, investment subsidies, and R&D grants could make Thailand more appealing for companies considering setting up semiconductor facilities. Public-private partnerships would also be crucial, allowing companies to benefit from both government support and Thailand’s established supply chain in electronics manufacturing.

2. Leveraging ASEAN Collaboration

Thailand could enhance its semiconductor sector by working with ASEAN partners rather than competing against them. By positioning itself as a reliable source of raw materials or by focusing on semiconductor testing and packaging, Thailand could play a unique role within the broader ASEAN semiconductor landscape. Collaborative agreements that allow Thailand to focus on specific segments of the semiconductor value chain could help it attract investments without needing to compete directly with established players like Singapore.

3. Reskilling and Upskilling the Workforce

Thailand must address the skills gap if it is to succeed in the semiconductor industry. The government and private sector could invest in training programs aimed at reskilling workers from the automotive and electronics sectors, capitalising on Thailand’s existing industrial base. Collaborations with academic institutions to develop specialised semiconductor courses would also help create a local talent pool for advanced semiconductor manufacturing roles.

The Stakes for Thailand: A Critical Moment in the Chip Race

The stakes for Thailand are high. According to The Business Times, the global semiconductor market could reach over $1 trillion by 2030, driven by demand for digitalisation, artificial intelligence, and electric vehicles. If Thailand fails to build a competitive semiconductor sector, it risks being left behind as other ASEAN countries reap the economic benefits of this booming industry. Furthermore, without a strong semiconductor presence, Thailand’s electronics and automotive sectors—which are highly dependent on chips—may become increasingly vulnerable to supply chain disruptions.

Thailand’s Race to Catch Up

Thailand’s journey to semiconductor relevance won’t be easy, but with swift, strategic moves, the country can avoid falling further behind in ASEAN’s competitive semiconductor market. By leveraging its manufacturing experience, strengthening government support, and focusing on targeted skill development, Thailand has a chance to build a niche role within the global semiconductor landscape. As the region’s chip race heats up, Thailand’s path forward will require vision, resilience, and a proactive approach. Failure to act decisively could leave Thailand sidelined in one of the most critical industries of the 21st century.

Similar read:

- Thailand’s Data Centre Boom: Paving the Way for AI Innovation

- Thailand’s Economy in 2024: Analyzing Q1, Q2 & Q3 Performance and Future Outlook

- Charging Ahead: Thailand’s Electric Vehicle Industry and Its Global Impact

Sources: The Business Times, The Nation, Business Korea, TheInvestor.vn, SCB EIC