Share This Article

Thailand’s economic journey through 2024 has been a tale of recovery and recalibration. While driven by a recovering tourism sector and strong private consumption, challenges such as declining exports, contraction in manufacturing, and fiscal delays have tempered the overall expansion.

As we dissect the performance across the first three quarters, we uncover the underlying trends shaping the country’s economic landscape and what they might signal for the future.

1. Q1 2024: A Mixed Start with Tourism as a Beacon of Growth

The first quarter of 2024 saw Thailand’s GDP grow by 1.5% year-on-year (YoY), consistent with market expectations but slowing from a 1.7% growth in Q4 2023. This modest growth was bolstered by the robust performance of the tourism sector, which saw international arrivals surge by 43.5% compared to the previous year. Private consumption also showed strength, particularly in service activities related to tourism, which recorded a 13.7% increase. However, this was counterbalanced by a decline in government consumption and public investment, leading to an overall tempered economic performance.

2. Q2 2024: Export Struggles and Manufacturing Decline

In Q2, Thailand’s economy continued to face headwinds, with GDP growth slowing to 1.5% YoY. Exports of goods, which are typically a cornerstone of the Thai economy, contracted by 1.0% in the first quarter, signalling trouble ahead for the manufacturing sector, which continued its decline into Q2. The Manufacturing Production Index (MPI) dropped by 3.0%, reflecting contractions in key sectors such as automotive and electronics. On the positive side, the tourism sector remained resilient, providing a cushion against broader economic slowdowns.

3. Q3 2024: Resilience Amidst Fiscal Uncertainty

The third quarter of 2024 did not bring significant relief, as the economy grew by just 1.5% YoY. The delay in fiscal policy implementation, particularly the disbursement of the 2024 budget, continued to hamper public investment. Despite this, private consumption remained a bright spot, driven by sustained tourism and improved consumer confidence. Additionally, the agricultural sector struggled due to adverse weather conditions, further limiting economic expansion.

4. Key Challenges: Manufacturing Woes and Export Contraction

A recurring theme throughout 2024 has been the struggle of Thailand’s manufacturing sector, which faced a persistent decline due to weak global demand and internal inefficiencies. The export contraction, particularly in the automotive and electronics industries, added pressure on the economy. Moreover, geopolitical tensions and global financial market volatility introduced additional layers of uncertainty, affecting investor confidence and capital flows.

5. Outlook for Q4 2024 and Beyond: Cautious Optimism

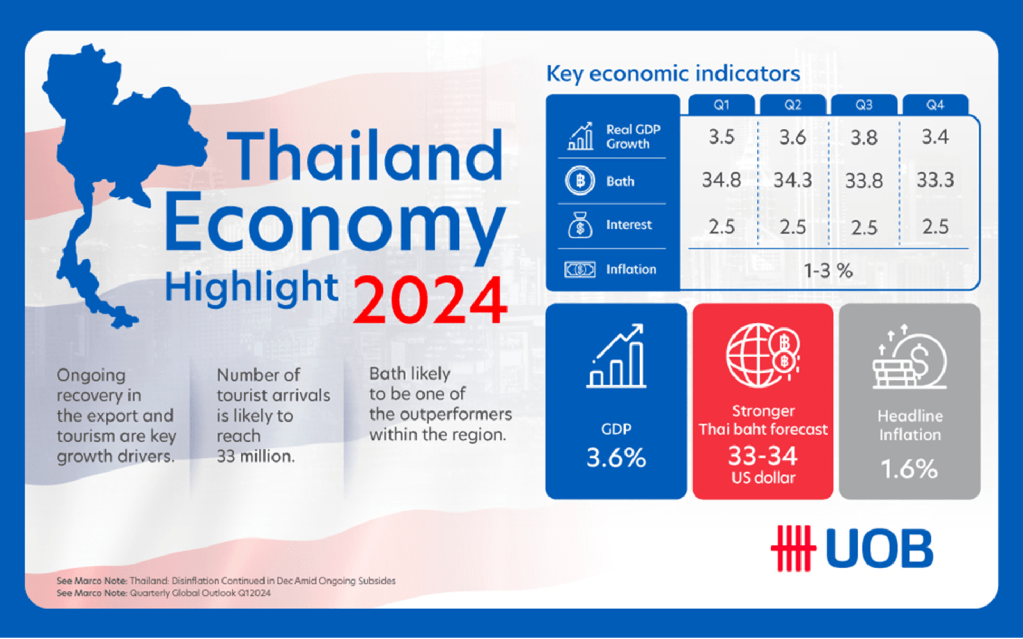

Thailand’s economic outlook remains cautiously optimistic. The government’s fiscal stimulus measures, if fully implemented in Q4, could provide a much-needed boost to economic activity. Additionally, the anticipated continuation of strong tourism performance in favour of the free visa policy could further support GDP growth. However, the potential decline in average tourist spending due to the shift in visitor demographics could temper the positive impact of increased arrivals. Lingering challenges in the export and manufacturing sectors, coupled with potential global economic slowdowns, suggest that Thailand’s economy may only achieve moderate growth for the year, with projections hovering around 2.5%.

Conclusion

Thailand’s economy in 2024 has been a story of partial recovery, driven by tourism and private consumption, yet hindered by external and internal challenges. As the year progresses into its final quarter, the nation’s economic fate hinges on the effective execution of fiscal policies and a possible global economic rebound. Stakeholders should remain vigilant, balancing optimism with preparedness for ongoing volatility.

Similar read:

- Profitable Pursuits: Thailand’s Emerging Industries for Foreign Investors

- Thailand Property Investment: Your Guide to Condos, Villas & More

- Soaring Prices for New High-End Condominiums in Bangkok: A Market Overview

Sources: NESDC News, SCBEIC, Kasikorn Bank, FPO.go.th, World Bank